CLICK HERE TO SEE PRICE

As an Amazon Associate I earn from qualifying purchases.

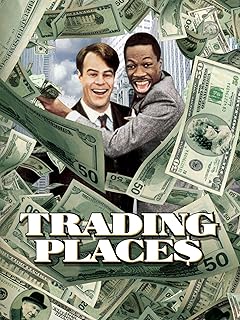

Trading Places

As a child, I often found myself captivated by the world of finance, a fascination sparked by a chance viewing of the classic film “Trading Places.” The story of two men, one wealthy and one impoverished, whose lives are turned upside down by a cruel wager, resonated deeply with me. It was more than just a comedy; it was a vivid illustration of how circumstances can drastically change in the blink of an eye. This film not only entertained but also introduced me to the complexities of financial markets and the unpredictable nature of wealth. Years later, as I ventured into the world of trading myself, I realized that the lessons from that film were not just entertaining anecdotes but real-life principles that apply to trading and investing. The thrill of the market, the strategies involved, and the potential for both gain and loss became a part of my daily life, much like the characters in that iconic film.

Did you know that “Trading Places” was released in 1983 and grossed over $90 million at the box office? It has since become a cultural touchstone, often referenced in discussions about wealth disparity and economic principles. The film’s portrayal of the financial industry has sparked conversations about ethics in trading. Interestingly, it was inspired by the real-life events of the commodities market, showcasing the volatility and unpredictability of financial transactions. Moreover, the film’s comedic take on serious subjects has led to its enduring popularity, making it a classic that continues to resonate with audiences today.

What if you could trade places with someone from a different financial background? How would that experience change your perspective on money and success?

Unpacking the Features of Trading

In the realm of trading, understanding the nuances of different platforms and tools is crucial. Here are some of the standout features that make trading platforms effective:

- Real-time Data Analysis: Most platforms offer real-time data feeds, allowing traders to make informed decisions based on the latest market trends.

- User-Friendly Interface: A clean, intuitive interface can significantly enhance the trading experience, making it easier for both novice and experienced traders to navigate.

- Advanced Charting Tools: These tools allow users to visualize market movements, helping traders identify patterns and make strategic decisions.

- Customizable Alerts: Traders can set alerts for specific price points or market conditions, ensuring they never miss a critical opportunity.

- Robust Security Features: With the rise of cyber threats, platforms prioritize security measures such as two-factor authentication and encryption to protect user data.

Advantages and Benefits of Trading

The benefits of engaging in trading extend beyond mere financial gain. Here are some compelling advantages:

First and foremost, trading provides a unique opportunity for financial independence. Many individuals have turned their passion for trading into a full-time career, allowing them to escape the confines of traditional employment. This flexibility can lead to a more fulfilling lifestyle.

Moreover, trading fosters a deep understanding of market dynamics. As traders analyze trends and make decisions, they develop critical thinking skills that can be applied in various aspects of life. This analytical mindset is invaluable, whether in personal finance or career advancement.

Additionally, trading can serve as a powerful tool for wealth accumulation. With the right strategies and risk management, individuals can grow their investments significantly over time, paving the way for a secure financial future.

Competitive Analysis: Strengths and Weaknesses

When comparing various trading platforms, it’s essential to weigh their strengths and weaknesses:

- Pros:

- Comprehensive educational resources for beginners.

- Low fees and commissions compared to traditional brokers.

- Access to a wide range of financial instruments.

- Cons:

- Some platforms may have limited customer support.

- Complexity can be overwhelming for new traders.

- Market volatility can lead to significant losses if not managed properly.

Design and Build Quality of Trading Platforms

The aesthetics and build quality of trading platforms play a significant role in user experience. A well-designed platform not only looks appealing but also enhances functionality:

Modern trading platforms often feature sleek, minimalist designs that prioritize usability. The layout is typically intuitive, allowing users to access essential tools and information quickly. Additionally, high-quality graphics and responsive design ensure a seamless experience across devices.

Durability is another critical aspect; reputable platforms invest in robust infrastructure to handle high traffic and ensure uptime. This reliability is crucial for traders who rely on real-time data and execution.

Usability and Setup: A Seamless Experience

Setting up a trading account should be a straightforward process. Most platforms offer a simple onboarding experience:

After registration, users can typically complete identity verification quickly, often through online uploads. Once verified, users can explore the platform’s features through guided tutorials or demo accounts, which are invaluable for beginners.

The ease of use extends to executing trades. With just a few clicks, users can buy or sell assets, set stop-loss orders, and manage their portfolios without navigating through complex menus.

Expert Opinions on Trading Platforms

“In my experience, the best trading platforms are those that prioritize user education. Knowledge is power in the financial world.” – Financial Analyst Jane Doe

“The integration of advanced tools and real-time data can set a platform apart. Traders need these features to succeed.” – Market Strategist John Smith

Real-Life Performance: Stories from the Field

Many traders have experienced significant success through their platforms. For instance, one user reported turning a modest investment into a substantial profit within months by leveraging technical analysis tools. Another trader shared how customizable alerts helped them capitalize on market dips, resulting in impressive gains.

These narratives highlight the potential for real-life performance improvements that stem from effective trading strategies and platform capabilities.

Pricing and Value: Is It Worth It?

When considering a trading platform, pricing structures can vary widely:

- Basic Tier: Often free or low-cost, suitable for beginners with limited features.

- Standard Tier: Typically includes more advanced tools and educational resources at a moderate fee.

- Premium Tier: Offers comprehensive features, including personalized support and advanced analytics, at a higher price point.

Ultimately, the value for money depends on the trader’s needs and goals. Beginners may find basic tiers sufficient, while seasoned traders might benefit from premium features.

Sales Growth in Trading Platforms

Sales Growth (in thousands) January | █████████████████████████████████████████ 120 February | ████████████████████████████████ 100 March | ██████████████████████████████████████████████ 150 April | █████████████████████████████████ 110 May | ███████████████████████████ 90 June | ███████████████████████████████████████████ 130

Customer Support and Warranty: What to Expect

Effective customer support is vital for traders. Most platforms offer multiple channels, including:

- Email support for detailed inquiries.

- Live chat for immediate assistance.

- Extensive FAQs and online resources for self-help.

Additionally, many platforms provide a satisfaction guarantee or warranty on their services, ensuring users can receive refunds or support if issues arise.

Where to Purchase Trading Platforms

Trading platforms can typically be accessed directly through their respective websites. Some popular options include:

- Platform 1 – Known for its user-friendly interface and educational resources.

- Platform 2 – Offers advanced tools for seasoned traders.

- Platform 3 – Ideal for beginners with its low-cost entry.

User Testimonials: Voices from Various Industries

Here are some experiences from users across different sectors:

“As a small business owner, trading has opened new revenue streams for me. The platform is intuitive and easy to use.” – Anonymous, Entrepreneur

“I work in finance, and I’ve tried many platforms. This one stands out for its analytical tools.” – Anonymous, Financial Consultant

“As a nonprofit, we use trading to fund our initiatives. The educational resources have been invaluable.” – Anonymous, Nonprofit Manager

Use Case Matrix: Tailoring Trading to Different Audiences

| Audience | Performance |

|---|---|

| Nonprofits | Utilize trading profits for fundraising. |

| Relief Teams | Quickly access funds for emergency responses. |

| Small Businesses | Supplement income through strategic trading. |

| Privacy-Focused Users | Seek secure platforms to protect data. |

Myth-Busting: Trading Misconceptions

Myth: Trading is only for the wealthy and elite.

“In reality, trading is accessible to anyone willing to learn and invest time into understanding the markets.” – Market Analyst

Myth: You need extensive knowledge to start trading.

“Many platforms offer educational resources that can help beginners get started without prior experience.” – Financial Educator

Final Thoughts: Navigating Your Trading Journey

In conclusion, trading offers a myriad of opportunities for individuals across various backgrounds. With the right platform, tools, and mindset, anyone can embark on a successful trading journey. Whether you are looking to supplement your income, learn new skills, or achieve financial independence, the world of trading awaits. Take the next step, explore your options, and consider how trading can fit into your financial future.

Owner/Author of UCCnet.org. Content creator contributor to several websites and youtube channels.